Agent partnership

Agent partnership not only allows the Agent earning money on attracting new Follower account holders to PAMM account, but also boosts Master’s profit by increasing the number of Followers.

Agent partnership

Agent partnership not only allows the Agent earning money on attracting new Follower account holders to PAMM account, but also boosts Master’s profit by increasing the number of Followers.

09/03 16:47

Overview of FXOpen's Best-performing PAMM Accounts of February 2023

Congratulations on the end of winter and the beginning of spring! Since the beginning of spring, global problems have not diminished, but many PAMM managers do not seem to care. They continue to trade actively, easily adapting to the changing market. Investors, on the other hand, pursue a logical and understandable goal: to invest their savings in the most promising PAMM accounts with minimal risk and maximum profit.

As of 03/01/2023, investments amounted to 1,660,558.00 USD on 127 FXOpen PAMM accounts (according to Investflow monitoring statistics).

The provider, who has been actively trading on the FXOpen site since September 2022, shows positive trading results. During trading, the maximum drawdown reached 10.28%, trading statistics show that the trader trades carefully and with minimal risks. In February, the profit was 36.81%. The maximum drawdown for the last month was 3.02%, the load did not exceed 13.95%. The trader was trading mainly in gold (XAUUSD). One can join this manager for the minimum amount of 200 USD.

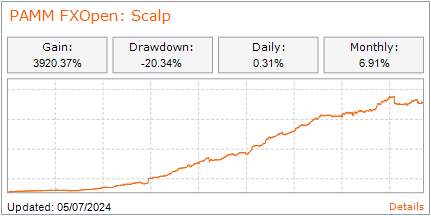

The account was opened in August 2019, but this trader has been active on the FXOpen site since November 2022. Features of their trading: low risks, low deposit loading, moderate profitability. According to the account, the maximum drawdown is kept at the level of 20.34%. In February, +4.59% was earned with a maximum drawdown for the period of 1.42%. A rather high percentage of all completed transactions are closed with a positive result: 84%. Main trading pairs: EURAUD, GBPCAD, USDCAD, and CHFJPY. One can join this manager for 100 USD.

One of the best providers of the last year, trading without significant difficulties since March 2014. In February, the yield can hardly be called high at just 0.5%, but their stability should be taken into account, so it will always look interesting in the investment portfolio. The floating drawdown in February did not exceed 4.59% with a deposit load of 9.35%. The main trading pair is NZDCAD. At the beginning of March, there is a small working drawdown in the account. One can join this manager for at least 1000 USD.

Another stable provider trading since June 2020. Investors like their moderate risks and high returns. The maximum drawdown since opening the account is 28.52%. The provider started this year successfully. In February, the yield on the account was 8.77% with a zero maximum drawdown and a deposit load of about 8%. At the time of writing the review, no floating drawdown is observed. Trading is carried out in the following currency pairs: AUDCAD, NZDCAD, and AUDNZD. One can join the account for 1 USD.

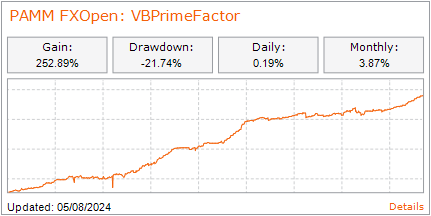

This provider's account was opened in August 2021. Trading can be described as positive and dynamic, as evidenced by a fairly high profitability and a low level of maximum drawdown — 21.74%. In February, the profit was 11.03% with a deposit load of 1.12% and a maximum drawdown of 0.21%. Main trading pairs: GBPUSD, EURUSD, EURCAD, AUDCAD. One can join this account for at least 1000 USD.

This provider opened their EUR account with FXOpen in September 2022. They are trading confidently and with mostly positive results. For the entire period of the account, the maximum drawdown did not exceed 4.75%, which indicates very low risks. The yield in February was 5.10%. At the same time, the deposit load did not exceed 0.73% with a maximum drawdown of 0.25%. Trading is carried out only in one currency pair, EURUSD. The trader's last negative week was in November. One can join this account for 900 USD.

The account has been trading since May 2021. Trade can be characterized as stable and conservative. The maximum drawdown is still at 10.58%. In February, the trader was able to earn 1.71% profit with a maximum drawdown of 6.98% and a deposit load of 18.36%. It is worth noting that February trading was tense with increased risks. By March, the situation had stabilized. It is possible to join this PAMM account for 10 USD or more. The penalty for early withdrawal is 25%, but the higher the amount, the lower the penalty for early withdrawal.

The provider started 2023 successfully: two months in a row with a positive result. In February, the provider was able to earn +5.26% with a maximum drawdown of 1.98% and a deposit load of 1.08%. In February, trading was carried out in the following trading pairs: CADJPY, USDJPY, EURCAD. At the time of writing the review, the account has a small working drawdown slightly above 1%. One can join this trader for just $100, and there is no penalty for early withdrawal.

This provider has been trading on the FXOpen platform since May 2022 and is showing excellent results. The start of 2023 was successful. The maximum drawdown is kept within 12.68%. In February, the trader was able to earn +22.46%. The main trading pair is AUDCAD. In February, the maximum drawdown did not exceed 2.77%, the deposit load was at the level of 7.04%. One can join this manager for 50 USD, there is a small penalty for early withdrawal in the amount of 5%.

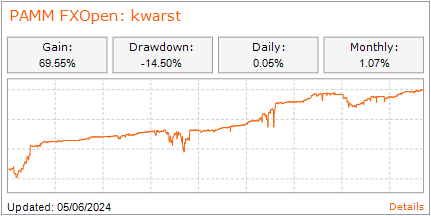

This provider has been trading since 2020, and is considered one of the most conservative traders with low risks. The maximum drawdown on the account remains at the level of 14.50%. In February, the profit was +1.63%, but the account has always been considered very promising. During the period under review, the maximum drawdown was only 0.43%. In February, the trader was trading mainly in the GBPUSD, EURUSD, and AUDUSD currency pairs. One can join this offer for 100 USD, and there is no penalty for early withdrawal of funds.